Looking At Your Mortgage Options?

Make Sense of Your Dollars With These Services

Our mortgage calculator below estimates your monthly payments and full amortization schedule for the life of your mortgage. Whether your are purchasing your first property or looking for an investment property, knowing your options and cash flow implications is critical in making sound financial decisions.

With our calculator, you cannot only use it, but have it mailed to you, get a printed copy and use to talk to your mortgage broker.

Annual interest rate

The annual interest rate used to calculate your monthly payment. Please note that the interest rate is different from the Annual Percentage Rate (APR), which

Original mortgage term

Total length, or term, of your original mortgage in years. Common terms are 15, 20 and 30 years.

Years Remaining

Total number of years remaining on your original mortgage.

Original mortgage amount

The original amount financed with your mortgage, not to be confused with the remaining balance or principal balance.

Additional principal payment

It is long established sed fact will distracted by sed the readable content of a page when looking when layout more collections finish.

Current mortgage payment

Monthly principal and interest payment (PI) based on your original mortgage amount, term and interest rate.

Monthly accelerated payment

Scheduled payment plus your additional principal payment.

Total savings

Total amount you would save in interest if you made the accelerated payment until your mortgage was paid in full.

Frequently Asked Questions

Is the mortage calculator for free?

Yes and depending on your situation there could be many options available for you.

I’m self employed, not working or on disability, can you help?

Yes, and depending on your situation there could be many options available for you.

I have credit issues, can I still qualify?

Yes, there are many options available for almost any scenario. There’s no one size, fits all solutions and I’ll make a customized plan that’s tailored to fit your needs.

What three numbers are required?

Yes and depending on your situation there could be many options available for you.

How much do I need for a down payment?

A minimum down payment of 5- 20% is required. If your down payment is less than 20% then you will have to purchase mortgage insurance.

Best Options For Mortgage & Loans

All In One Place

We Are On Your Side

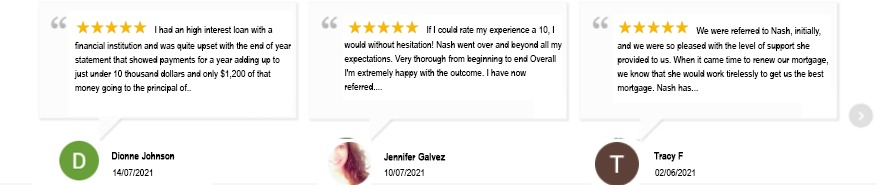

Our tools, expertise, and deep knowledge of everything personal finance helps us provide a 5 star service our customers love!

I need help with a payment calculator

Tempor incididunt ut labore et dolore magna aliqu enim minim sed ut veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex eay commodo consequat. Duis aute irure dolor in reprehenderit in at seds voluptate velit esse cillum dolore eu fugiat.